Best Practices for Corporate Sustainability Teams

This report—based on a survey of 70 corporate sustainability and environmental, social & governance (ESG) leaders at US and multinational firms—examines and shares best practices on how companies structure and position their sustainability teams, how they interact with other business functions, and how those choices shape overall efficiency and effectiveness.

Trusted Insights for What’s Ahead®

- Most surveyed companies favor a “hybrid” internal sustainability structure—combining a lean central team with distributed responsibilities across business units—as it enables strategic oversight, operational integration, and efficient use of resources.

- Half of surveyed firms plan structural adjustments over the next two years to strengthen sustainability coordination and alignment to allow for closer business integration, long-term resilience, and regulatory readiness.

- Most companies embed sustainability into some processes but not enterprise-wide; over the next two years, survey respondents expect to integrate sustainability more deeply in functions such as finance, procurement, and risk management.

- A cross-functional steering committee is the most-cited way to advance sustainability integration, but broader change management is needed to address cultural barriers and competing mandates.

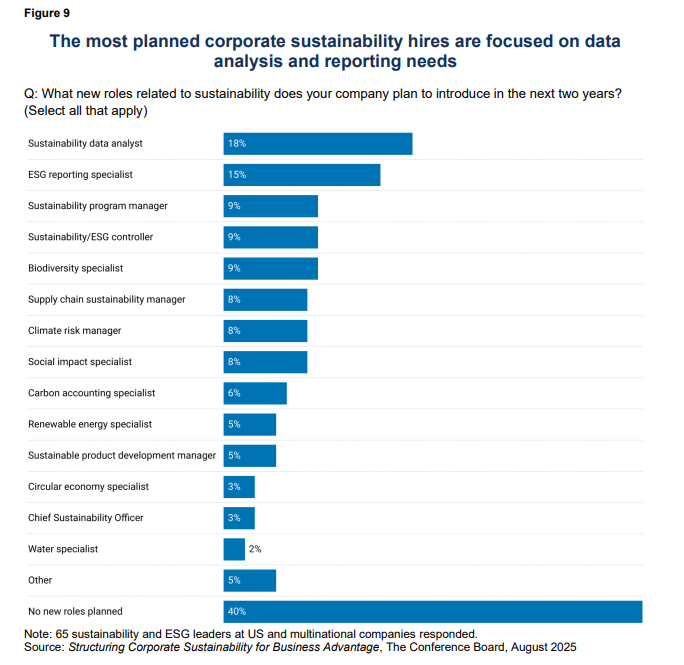

- The most notable sustainability talent gaps—financial modeling, change management, and data analysis—reflect the function’s shift toward core strategy and decision-making, although budget limits mean only 60% of firms plan to add roles in the next two years.

| Corporate sustainability refers to how companies align business strategy with environmental stewardship, social responsibility, and long-term economic performance to create value for both shareholders and stakeholders. These efforts are typically led internally by a chief sustainability officer or equivalent, supported by a dedicated team. How those teams are structured and positioned determines their influence, effectiveness, and alignment with core business priorities. Organizational design is therefore a strategic lever—shaping whether sustainability remains peripheral or becomes a driver of competitiveness, risk management, and long-term value creation. |

Corporate Sustainability Team Structures

How sustainability engages with other functions directly shapes the company’s ability to embed ESG considerations into core processes, meet regulatory demands, and capture business opportunities. In 2025, these organizational questions have taken on added weight as companies operate in an environment characterized by regulatory complexity, shifting policy priorities, heightened legal and stakeholder scrutiny, and broader economic uncertainty.

In practice, surveyed firms show a clear preference for a “hybrid” model. This structure pairs a central team responsible for strategy, standards, and governance with departmental liaisons who embed sustainability into daily operations. This model has gained traction for balancing the consistency and oversight of a centralized team with the relevance and accountability of distributed ownership. The preference is also reinforced by resource constraints: at over 60% of firms The Conference Board surveyed in early 2024, the core sustainability team is composed of just one to five full-time employees, making the hybrid model an efficient way to extend reach and influence across the organization.

Less common organizational approaches cited in the current survey include centralized models (19%), which provide tight control, consistent messaging, and efficiency but can be slower to embed sustainability into business-unit decision-making. Distributed models (9%), once more prevalent, promote local ownership but they carry the risk that the sustainability strategy will become fragmented and misaligned without a strong central anchor. None of the surveyed firms use fully decentralized approaches with no central team or defined structure, reflecting the mainstreaming of sustainability and heightened stakeholder expectations for coordinated, enterprise-wide governance.

How companies govern and organize for sustainability is still evolving. Half of surveyed firms plan to adjust their sustainability structures within the next two years, though only 16% anticipate major restructuring, while 34% expect minor changes. Among these companies, the most common planned changes reflect a focus on integration and coordination (Figure 2):

- Strengthening cross-functional sustainability collaboration: The top-cited priority, reflecting recognition that delivery on sustainability goals depends on seamless cooperation across business units, functions, and geographies. This also supports the prevailing hybrid model, where central teams set direction and distributed roles drive execution.

- Integrating sustainability into risk and finance functions: A deliberate step toward embedding ESG factors into enterprise risk management, capital allocation, and financial reporting, which positions companies to meet the growing demands of regulatory disclosure requirements and investor scrutiny.

- Embedding sustainability into core strategy and operations: Marks a transition from sustainability as a peripheral overlay to a central component of competitive positioning, operational resilience, and long-term value creation.

- Redistributing sustainability roles across business units: Expands operational ownership and accountability, enabling execution at scale while maintaining strategic coherence and oversight from the central team.

Survey respondents cite three main drivers for these potential changes in sustainability structure: stronger integration with core business strategy, preparation for long-term business model resilience, and adaptation to new regulatory and disclosure requirements (Figure 3). The prominence of strategy and resilience—alongside compliance—indicates that structural shifts are aimed less at adding capacity and more at embedding sustainability into central decision-making and value creation. Priorities for sustainability leaders include structures that link sustainability to strategic planning, risk management, and capital allocation; building capabilities for data-driven execution; and streamlining governance for faster, more accountable decisions.

Integrating Sustainability into the Business

Strengthening integration with the goals, purpose, and strategy of the wider business is a major factor shaping how sustainability leaders plan to adjust the structure of their teams and how the function itself is resourced. Effective integration can help elevate sustainability from a compliance or reputational exercise to a driver of competitiveness, resilience, and investor confidence, enabling companies to anticipate and adapt to regulatory changes, stakeholder expectations, and market trends while capturing opportunities such as efficiency gains and talent or customer differentiation. Without it, sustainability risks becoming siloed and disconnected from the levers that shape business performance.

A 2024 poll by The Conference Board found full enterprise-wide integration remains rare, with most respondents (66%) reporting moderate integration (Figure 4), meaning sustainability is embedded in some core processes but not across the business. The extent and nature of integration vary widely across industries, companies, and functions, but survey data point to common patterns (Figure 5). Integration is most advanced in legal, communications/marketing, procurement, operations, and philanthropy, while it is relatively low in innovation/R&D, human resources, finance, investor relations, and risk management—highlighting untapped potential to embed sustainability more deeply into product design, talent management, capital allocation, and other strategic business areas.

Looking ahead, survey respondents expect strong momentum toward deeper integration of sustainability over the next two years, including functions currently only moderately aligned (Figure 6). In particular, sustainability leaders anticipate greater alignment with:

- Finance: Expanding regulatory disclosure requirements such as the EU’s Corporate Sustainability Reporting Directive and California’s climate reporting laws, along with intensifying investor scrutiny, are positioning finance at the center of sustainability integration. Finance teams will play a pivotal role in ensuring disclosures are assurance ready and investor grade, as well as embedding ESG metrics more broadly into capital allocation, forecasting, and reporting.

- Procurement/supply chain: Rising expectations for scope 3 emissions reduction, ethical sourcing, and supplier transparency make procurement a critical partner. Companies can strengthen alignment by embedding sustainability performance into supplier selection and contracts and investing in tools that provide real-time visibility into supply chain ESG data.

- Risk management: Climate, resource, and social risks are increasingly material to enterprise resilience. Sustainability teams should integrate ESG risks into the enterprise risk register, scenario planning, and board reporting, aligned with the company’s strategic risk appetite.

- Operations: Operational efficiency, decarbonization, and waste reduction remain direct levers for meeting sustainability targets. Partnering with operations to set site-level KPIs, link them to incentives, and monitor environmental impact data can accelerate progress.

- Innovation/R&D: Sustainability-driven innovation can open new markets, products, and services while strengthening competitive advantage. Yet many firms have not aligned innovation pipelines with sustainability goals—an untapped opportunity. Cross-functional partnerships can help prioritize low-carbon, resource-efficient products and processes, with life cycle sustainability assessments embedded into development gates.

- Legal/Compliance: Already closely aligned, legal’s role will grow as mandatory ESG disclosure regulations demand robust compliance systems and defensible disclosures. Many companies have also expanded legal and risk oversight of sustainability in 2025 to navigate heightened scrutiny in a shifting US political and regulatory landscape.

While specific tactics for integrating sustainability vary by company and function, survey data highlight broad strategies that deliver the greatest impact (Figure 7):

- Establishing a cross-functional sustainability steering committee: The most widely cited success factor, this approach creates formal governance, ensures cross-business coordination, and drives accountability. According to previous research from The Conference Board, companies with a cross-functional sustainability steering committee—at or below the C-Suite level—report significantly higher program effectiveness than those without one. These committees are not symbolic; they can enable structural alignment, accelerate decision-making, and ensure resources follow priorities.

- Tying sustainability goals to financial and operational KPIs: Embedding ESG objectives into the same performance measures used to track profitability, efficiency, and growth keeps sustainability visible and measurable at the highest level. This reinforces its strategic importance and creates a common language across functions, helping finance, operations, and sustainability teams work from shared benchmarks.

- Embedding sustainability into performance metrics and incentives: Linking individual or team evaluations and rewards to sustainability outcomes can incentivize consistent action. However, this approach has become more complex in the US due to increased stakeholder scrutiny, and the use of certain metrics—particularly emissions reduction, diversity and inclusion, responsible sourcing, and composite ESG scores—has declined since peaking in 2023–2024. Where used, these metrics must be carefully designed to be material, verifiable, and resistant to external criticism.

While these specific strategies are important, shifts in structure and governance will not deliver lasting results without deliberate, effective change management to overcome resistance, close knowledge gaps, align conflicting priorities, and bridge cultural differences between teams. At the same time, sustainability leaders also need to manage tensions between overarching sustainability goals and departmental mandates, as well as capacity constraints that can slow execution. Success hinges on sustained executive sponsorship, clear communication of the business case, targeted capability-building, and real-time conflict resolution to ensure integration efforts are durable, credible, and embedded in the company’s operating rhythm.

Sustainability Talent Gaps and Opportunities

As corporate sustainability programs mature and align more closely with core business strategy, team composition and capabilities become critical to success. With most central teams lean— rarely more than six to 10 full-time professionals—and 2025 marked by persistent budget constraints and cost cutting, staffing must be strategic and efficient. In the predominant “hybrid” model, this requires a core group with the expertise to set direction, ensure governance, and manage enterprise-wide priorities, supported by functional experts across the business and embedded sustainability knowledge where it can directly shape day-to-day decision-making.

Ensuring the right mix of expertise, bolstered by career development opportunities and clear pathways for influence, is therefore a strategic leadership priority, not merely a staffing concern. While over half of survey respondents rate their organization’s ability to attract and retain sustainability talent as “very strong” (11%) or “strong” (42%), significant capability gaps remain in key areas (Figure 8), in particular relating to business-sustainability integration skills and analytical capabilities. Notably, the most cited talent gaps are cross-functional, business-critical capabilities rather than purely “technical” skills.

» As companies embed sustainability into core operations, they require professionals who can align functions, influence without authority, and manage organizational change—yet sustainability leaders report that this mix of technical and interpersonal expertise is often lacking in graduates and specialists.

These capabilities are also foundational enablers: without financial modeling, leaders cannot make the business case; without effective change management, strategies stall; without robust data, progress cannot be measured or credibly reported. Building such skills internally is resource intensive but can be advanced through targeted upskilling, embedding expertise into existing processes, and leveraging strategic partnerships. Training employees who already understand company systems and culture is often more effective than hiring new ESG specialists unfamiliar with organizational context.

Despite rising demands, 40% of surveyed firms have no plans to add sustainability roles in the next two years, most often due to budget constraints (Figure 9). Planned hiring is concentrated on immediate needs in data and reporting, while emerging thematic areas such as biodiversity, circular economy, and social impact are typically added to existing staff portfolios. This places added pressure on lean central teams and underscores the need for sharper prioritization, greater investment in internal development, and stronger cross-functional collaboration.

Conclusion

The evolution of corporate sustainability will increasingly hinge on structures and capabilities that embed it into the core of business decision-making. In the years ahead, the most effective organizations will be those that align governance, talent, and integration strategies to navigate regulatory change, respond to market expectations, and turn sustainability into a driver of resilience and growth amid the realities of lean teams, constrained resources, and an evolving policy environment in the US and globally.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.