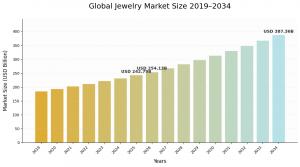

Jewelry Market Size to Reach USD 387.36 Billion by 2034, Growing at 5.41% CAGR (2026-2034)

Jewelry Market Size, Luxury Demand Trends, and Industry Outlook 2026–2034

Asia Pacific dominated the jewelry market with a market share of 39.23% in 2025”

PUNE, MAHARASHTRA, INDIA, February 8, 2026 /EINPresswire.com/ -- Jewelry Market Overview Analysis, 2026— Fortune Business Insights

The global jewelry industry demonstrates consistent expansion fueled by rising consumer affluence, evolving fashion preferences, and increasing integration of technology into traditional ornamental designs. Market analysis reveals sustained growth across diverse product categories and geographic regions through 2032.

Market Valuation and Growth Trajectory

The global jewelry market size was valued at USD 242.79 billion in 2025 and is projected to grow from USD 254.13 billion in 2026 to USD 387.36 billion by 2034, exhibiting a CAGR of 5.41% during the forecast period. Asia Pacific dominated the jewelry market with a market share of 39.23% in 2025.

Request a Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/jewelry-market-102107

Regional Market Leadership and Dynamics

Asia Pacific commands market dominance with a substantial 39.28% share in 2024, valued at $91.49 billion. This regional leadership stems from strong cultural traditions surrounding jewelry consumption, particularly in India and China where ornaments hold significant symbolic and ceremonial importance. Major regional brands including Tanishq, Malabar Gold & Diamonds, and Qeelin contribute substantially to market penetration. India's jewelry sector benefits particularly from gold's cultural significance in gift-giving traditions and ceremonial occasions, with the necklace segment alone capturing 23.13% market share in 2024.

North America exhibits robust growth driven by high concentrations of affluent consumers and established luxury brands such as Tiffany & Co. and Signet Jewelers. The United States market specifically benefits from strong luxury consumption patterns among high-net-worth individuals and increasing male participation in jewelry purchasing. European markets maintain significant presence through prestigious luxury brands including Cartier, Chanel, and Chopard, supported by elevated disposable incomes and sophisticated consumer preferences in France and Switzerland.

Emerging markets demonstrate notable expansion potential. Brazil's jewelry demand accelerates through international tourism growth, with tourist arrivals increasing 60% in 2022, stimulating local ornament sales. The Middle East, particularly the UAE and Saudi Arabia, sustains growth through luxury retail infrastructure and high-spending consumer bases, exemplified by L'azurde's 2021 premium collection launch featuring gold, diamonds, and precious stones.

Product Segmentation and Consumer Preferences

Rings maintain the largest product segment share, driven primarily by their symbolic significance in engagements and marriages. Consumer demand increasingly favors personalized ring designs, prompting manufacturers to offer extensive customization options encompassing material selection, design variations, gemstone choices, and sizing specifications. Tiffany & Co. exemplifies this trend through comprehensive online customization platforms providing detailed guidance on metals, diamonds, cuts, colors, and carats.

The necklace segment commands approximately 21.48% market share in 2024, sustained by cultural traditions and aesthetic preferences across various demographics. Earrings, bracelets, and other ornamental categories demonstrate significant presence, particularly among female consumers seeking beautification and personal expression through accessories.

Material Type Analysis

Diamonds dominate material type segmentation due to their exceptional light reflection properties and premium aesthetic appeal. Celebrity and influencer preferences strongly influence diamond jewelry consumption, as evidenced by widespread diamond and platinum ornament displays at high-profile events like the 2019 Met Gala, where prominent celebrities showcased colorful diamond pieces.

Gold maintains substantial market presence supported by increasing consumer awareness of health benefits associated with gold ornaments. Additionally, gold jewelry's investment value provides financial security considerations during economic uncertainties including inflation, market volatility, and financial instability, thereby sustaining consumer interest across economic cycles.

Technological Integration and Innovation

Technology advancement significantly impacts contemporary jewelry design and manufacturing processes. Post-pandemic technological adoption accelerates product innovation, particularly in smart jewelry integration. Products such as the Ringly Luxe Smart Ring demonstrate convergence between traditional aesthetics and modern functionality, featuring 14k gold-plated construction with embedded technology for activity tracking, calorie monitoring, distance measurement, and step counting. GPS tracking integration addresses security concerns regarding loss and theft, enhancing consumer confidence in high-value jewelry purchases.

Digital media platforms increasingly influence jewelry consumption patterns through fashion presentations in reality shows, movies, and music videos, cultivating enhanced consumer interest in fashion accessories including ornamental products. Social media marketing and celebrity endorsements amplify brand visibility and consumer engagement.

Distribution Channel Evolution

The COVID-19 pandemic fundamentally altered jewelry distribution dynamics, accelerating e-commerce adoption as consumers sought safe purchasing alternatives during lockdowns. Online platforms now represent critical sales channels, though traditional retail maintains relevance with consumers valuing in-person examination and fitting experiences. Major brands expand distribution networks through strategic store openings, exemplified by Aditya Birla Group's February 2024 launch of Novel Jewels Ltd. and Malabar Gold & Diamonds' January 2022 opening of six UAE showrooms.

Market Drivers and Challenges

Several factors propel market expansion. Rising female workforce participation, reaching 46.3% globally in 2021 according to International Labor Organization data, increases disposable income allocated toward jewelry purchases. Women demonstrate stronger inclination toward ornamental products for personal grooming and social status expression. Growing middle-class populations in developing economies further expand consumer bases seeking both traditional and contemporary jewelry designs.

However, market growth faces constraints from stringent import-export regulations increasing product tariffs and final costs, potentially deterring price-sensitive consumers. Value-added tax implementation, particularly tripling VAT rates in certain markets from July 2020, creates margin pressure for retailers while reducing consumer purchasing power. Supply chain disruptions during pandemic periods highlighted vulnerability in raw material sourcing and finished product distribution.

Press for an Enquiry: https://www.fortunebusinessinsights.com/enquiry/book-a-call/jewelry-market-102107

Competitive Landscape and Strategic Initiatives

Industry leaders pursue innovation-focused strategies to differentiate offerings and capture market share. Key players including Harry Winston, Chopard, Chow Tai Fook, Rajesh Exports, and LVMH Moët Hennessy invest substantially in design innovation, manufacturing excellence, and brand positioning. Tanishq's January 2023 U.S. market entry through New Jersey store opening, housing over 6,500 designs in 18 and 22-karat gold and diamonds, demonstrates geographic expansion strategies. Chaulaz Heritage Jewellery's September 2022 'Basra' bridal collection launch and online customization services illustrate brand differentiation through heritage craftsmanship and digital engagement.

The jewelry market exhibits resilience through cultural significance, investment value, and continuous adaptation to technological advancement and evolving consumer preferences across global markets.

Read More Research Reports:

Luxury Goods Market Size, Share & COVID-19 Impact Analysis

Diamond Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.